Gregg Masters 00:04

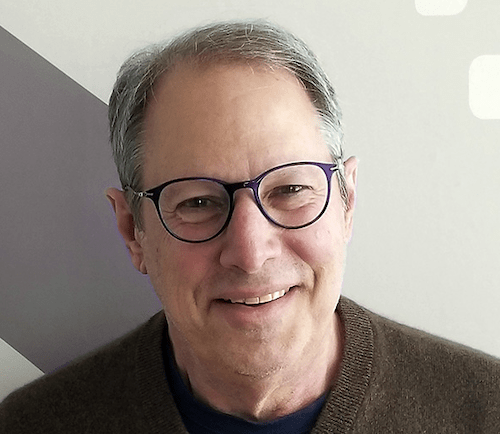

This episode of PopHealth Week is sponsored by Health Innovation Media. Health Innovation Media brings your brand narrative alive on the ground and in the virtual space for major trade show conference in innovation summits by our signature pop up studio connect with us at www.popupstudio.productions. I’m Gregg Masters, Managing Director of health innovation media and the producer and co host of PopHealth Week. And joining me in the virtual studio is my colleague, co founder and principal co host of PopHealth Week Fred Goldstein, President of Accountable Health, LLC, our guest today making an encore appearance is Brian Klepper, PhD, a healthcare analyst, commentator and entrepreneur who relentlessly focuses his attention on healthcare market dynamics and the drivers of the cost crisis. Brian is principal at Healthcare Performance, Inc, and Worksite Health Advisors both specialized health benefits consulting firms connecting high performance high impact healthcare organizations with organizational health care purchasers and health industry players. And with that introduction to our friend and colleague, Fred over to you help us get to know what is on Brian’s plate these days.

Fred Goldstein 01:21

Thanks so much, Gregg. And Brian, welcome to PopHealth Week.

Brian Klepper 01:23

Delighted to be here, Fred.

Fred Goldstein 01:25

Yeah, thanks so much. You’ve been one of the guests who’s probably been on almost as frequently as our number one guests, it’s always great to have you come back and learn about what’s going on in the employer space and benefit space, you’re always involved in some unique areas. And obviously, we’re still living in this world of COVID. So how is COVID impacted the employers and potentially municipalities you’re working with?

Brian Klepper 01:46

That’s an interesting question. I think that what we’ve seen is that is that public organizations here we’re talking about municipalities and, and state employee health plans and so on, organizations like that are have their have their backs up against the wall with with health care costs, costs has continued to increase rapidly and their, their tax bases have, have degraded under under the pandemic. And so for the very first time, a lot of them are willing to consider alternatives to conventional care approaches that are that are way better. They’re willing to explore those, even though they’re the BUCHAs, for example, don’t offer many alternatives of those types.

Fred Goldstein 02:37

And, you know, one of the things I was wondering, obviously, with all the COVID work going on some of the stuff we’ve been doing around COVID, is you mentioned it, they’re now being to focus on it, have they been able to begin to shift away from just considering COVID and how do they run their municipality organization? And now it sounds like they’re starting to get into looking at their benefits again.

Brian Klepper 02:55

Yeah, I think that’s I think that’s so, there’s a lot of activity with that I’m involved in with, with other brokers around with with brokers around the country, who who have access to these kinds of clients. And they they are clearly thinking more strategically now about their benefits and not just about COVID.

Fred Goldstein 03:20

Yeah, I can imagine, as you pointed out, which is something people sometimes don’t think about is, yeah, the benefit costs have continued to go up. But now these municipalities and others are dealing with reductions in revenue. So it’s even like a double whammy in a sense.

Brian Klepper 03:33

Yeah, it’s been pretty tough for them. I agree.

Fred Goldstein 03:37

And one of the things you always talk about, Brian, that’s fascinating is this idea of high performance healthcare. Can you define that from your perspective?

Brian Klepper 03:46

Yeah, I’m high. What I mean by high performance health care are our health care vendors of all types, who, who consistently deliver better health outcomes and or much lower cost than conventional approaches, particularly in high value niches. And by that I’m talking about places where the money money really is in, in musculoskeletal care, cardiometabolic care, chronic disease management, drug management, Claims Review, high claims resolution, specialty referral management, places that eat up a lot of the health care dollar, and, and that that have effectively developed new paradigms for how to manage within those niches.

Fred Goldstein 04:41

So when you talk about these niches, can you give us a sense of how much cost might be associated in one of those for an employer group or municipality or someone else running a benefits plan?

Brian Klepper 04:52

Yeah, so let’s let’s take the example of musculoskeletal in a typical employer musculoskeletal issues eat up about 20% of the group health costs, and 65, 75% of occupational health costs. So by the time you’re done, you’re at your 27, 28% of total healthcare spend. It’s a, it’s a huge, it’s a huge burden. And these new, better approaches can drop that spend in half. Musculoskeletal and orthopedics is a particularly good example, because there’s a large literature showing that about half of everything that’s done in that sector is inappropriate or unnecessary. And, and the these kinds of vendors give the proof of that they get better health outcomes in half the recovery time and half the cost of conventional approaches.

Fred Goldstein 05:55

And so how to companies or organizations interested in this area, and beginning to dig into their benefits package, one find, you know, identify that and two find a group that can actually do that kind of service.

Brian Klepper 06:14

Well, there, there are several ways as you know, as you and I know, you can you can go to a place like the Validation Institute and see whether whether they have vendors that they that they stand strongly behind who have been validated. Or you can call somebody who, who, who works in that in this particular space, like, like me, and and say, you know, who should I go to for chronic disease management? And what and why do you think that? And where’s the data for it? I mean, as it as it turns out, virtually everybody in healthcare claims they’re a high performer. But But the truth is in the data, and and so what you want to know is, most importantly, do they have longitudinal data showing that they consistently deliver better health outcomes or lower costs? Or both? Do they have? Do they have client testimonials? Are they scalable? Do they is there is their process enduring over time they? In other words, it’s great that they get great results after three months, do they still get great results after two years. Do they? Do they integrate with other other functions within the larger health care management ecosystem, because that’s really important that they may not just be standalone, and are they willing to guarantee their results. So for example, one, one musculoskeletal management vendor will financially guarantee a 25% reduction in total health care, in total musculoskeletal spend on the patients they touch. And that works out typically to a four to 6% reduction in total healthcare spend, but you’re really more likely to get double that because they they’re willing to guarantee about half of what they’re capable of producing. So you’re talking about, about an eight to 12% reduction in total healthcare spend by using a particular vendor within a high value niche, those are really big numbers.

Fred Goldstein 08:30

And one of the things you mentioned in that was this, this idea that everybody claims, they’re a high performer. And as you talked about, there’s this issue of data and getting the data and typically everyone who claims their high performer put some data in front of you. And so it can get very complicated, you know, as we both know, and perhaps you can touch on this as, as it really requires some detailed work to be able to vet those vendors and, and uncover whether what they’re saying is real. So you can then begin to bring in those people who truly make the difference. Right.

Brian Klepper 09:05

Yeah. And I think, I think that’s, that’s a critical point. I mean, it’s not exactly like, like, people in health care, don’t have the truth in them, but it’s close. And, and, and what you want is an independent third party expert, who, who can review the, the review what the, what the company is willing to put in front of you, and, and conclude that they’re there, that the results that you’re going to get in the real world are, you know, aligned with, with the results they claim they can get. And that that requires methodological rigor. So so that’s a that’s a special that’s a special set of set of skills that that need to be brought to the table. Yeah, you know, it’s, it’s worth pointing out now that you know, you happen to be extremely extremely good at at being able to discern whether somebody is blowing smoke or not.

Fred Goldstein 10:07

Well, thank thanks for that compliment. And one of the things I wonder, so let’s say I’m an employer a, and I’ve got this company with my and with my benefits plan, and it maybe it’s a fully insured package, maybe it’s a self insured package. And I’ve got a broker I’m working with, what should I be asking that person? Because wouldn’t most brokers want to be moving towards these types of approaches, or their disincentives that keep the industry from doing that?

Brian Klepper 10:33

Yeah, basically, brokers make more of health care costs more the same as the plans do. I think you’ve seen a chart that I that I put together that showed the the the stock price growth of the major health plans, since the ACA came into, into being and one of the lessons of that was that was that the major health plans have grown as much as five and a half percent per quarter, for 47 quarters in a row. It’s absolutely spectacular revenue growth associated with that, and that has made them you know, because they make more if if healthcare costs more, they are not very receptive to approaches in healthcare that are going to make healthcare costs less. So the major plans typically are not receptive to this, the brokers typically are not receptive. But innovative brokers are and they’re taking the long view. And, and so, so that’s a that’s a frame that employee benefit managers need to be very sensitive to. Because if the if the, if the broker is not willing to bring you solutions that are going to make things better, you probably need a different broker.

Fred Goldstein 11:58

And And along those lines, Brian, if you were looking at this from the viewpoint of the employer, what questions would you ask your broker

Brian Klepper 12:10

are there in this in this niche, are there better approaches, it helps, it helps to, to understand the numbers on on some of these, for example, American American medicine in general does a really lousy care, a lousy job with with managing chronic disease. So 44% of Americans who have high blood pressure, hypertension, have it under control. And what control means is that there are clinical metrics the clinical metrics on people with that condition in the population, are within acceptable limits, that that’s what control is, when you’re when you’re out of control, and you’re outside of those acceptable limits, bad things happen. In the case of cardiometabolic disease, that’s when people get heart attacks and strokes and amputations, and emergency visits and hospitalizations and a lot of diagnostics that make them cost way more than they otherwise would. There are new vendors out there that have tools that take that take that control in hypertension, and diabetes and high cholesterol and, and Heart Heart Failure up into the up into the 90% control. And so the difference in the in the in the capability of the care and the quality of the care, that that one type of vendor will give versus another can be very profound and can and can result in tremendous differences. Sometimes it’s sometimes it has to do with a mechanism there’s a there’s a specialty referral management organization, that that has developed a national network of virtual specialists, 200 virtual specialists across across specialties. And it turns out that about 40% of the of the specialty referrals that primary care doctors make, they already know what the end what the problem with the patient is, and they’re sending it to the specialist to get it to get it done. But on the other 60% they’re uncertain what the problem is. And so they’re sending it to the specialist to get further evaluation and recommendations. So it turns out that if you send if you send those 60% of patients to to a virtual specialist who doesn’t have a dog in the fight, who doesn’t who’s not not going to do procedures or diagnostics, but just just evaluate the patient that then you can watch the number of, of virtual specialty patients that get tracked better followed by by a face to face specialty visit. And so far, that number is about 20%, which means that 80% of the 60% of patients are getting better outcomes with with a reduction with with the elimination of diagnostics and, and, and procedures that would otherwise occur. And that, that, that 80% translates to something like a 20% reduction in total healthcare spend. It’s a it’s a, an immense amount of money by putting in a step in the healthcare process that’s part of part of the institutionalization of healthcare waste in the American system.

Fred Goldstein 15:50

And what you’ve talked about is a sounds like a technological approach, in a sense using telehealth, which obviously took off during COVID.

Brian Klepper 15:57

Yeah,

Fred Goldstein 15:57

are many of these technological solutions? Because we always hear Oh, we’re gonna throw this technology at it and solve the problem? Or are they more basic blocking and tackling type type things? Or is it is it a little bit of both,

Gregg Masters 16:08

and if you’re just tuning in, you’re listening to PopHealth Week, our guest is healthcare analysts, commentator, entrepreneur and principal of Healthcare Performance, Inc, and Worksite Health Advisors, Brian Klepper, PhD,

Brian Klepper 16:21

I’d say it’s a little bit of both. I think that I think that digital apps, for example, mobile apps are are given. Its, there’s an assumption that they’re going to take the world by storm, and they’re going to do better than the blocking and tackling will. But I’m a big advocate of the blocking and tackling. I mean, ultimately, digital apps are typically help people make better decisions of some type. And the problem with American healthcare is that patients make a lot of bad decisions. The problem is, is that the system is rigged in favor of the of the of the largest players. And so an app is not going to help you with that. It’s it’s worth mentioning that one of the equity firms recently did a study and found that there had been about $50 billion invested into into digital health technologies in the last five years. And, of course, every one of those investments was accompanied by a claim that it was going to be disruptive to the healthcare system, and not a single disruption occurred. So you know, from where, from where I sit in terms of looking at, at new ventures, I think a lot of money gets invested in ventures that have relatively little utility. And, and you have to sort of dig down deep to understand whether something really is really a special or not.

Fred Goldstein 18:03

And that kind of gets back to we had Lawton Burns on here, a while back, talking about, you know, these various ideas that are just BS in healthcare, I think was, was essentially the topic of the articles he wrote on it. And I think disruption was one of those terms, you know, being industry disrupter, obviously, we’ve seen that come out a lot. So what you know, again, is, as employers look at this, is it, is it really about digging into your claims data, identifying those few areas? And should they like, look and say, well, let’s target one of them. Let’s look at the whole, a couple of them. How would they how should they go about trying to handle that?

Brian Klepper 18:44

I think I think that the issue there is, is to look at where the money is. And, and to say, Where can I have it? Where can I have the greatest possible positive impact with the least disruption to my, to my benefits system. So an example of that is Claims Review. You know, there are organizations that do really good Claims Review, particularly looking at hospital hospital claims, and consistently deliver about a 17 to 25% reduction, return of the money that’s been paid to for hospitalizations, because of the way that they’ve been the the, the services have been, have been billed and and paid for. That’s, that’s a huge number and, and in that kind of mech in that kind of service. It doesn’t affect the patient at all. The pay the the employer sends in their claims data, a review is done on the claims data and then six or eight weeks later, a check arrives. So that kind of that kind of approach gets employers to wrap their heads around the fact that that, that these better approaches are out there and available and possible. And so they’re more likely to do something else that that’s, that’s innovative as well.

Fred Goldstein 20:18

One of the areas obviously has been hugely impacted by COVID. Work From Home, kids at home. All of that is stress, anxiety, behavioral health, you want to call it brain health. Are you seeing any innovative approaches in that area?

Brian Klepper 20:34

Yeah, there’s there’s a, there’s a flurry. Actually, it’s a blizzard of, of new ventures in that space, that are focused on evidence, evidence based techniques, and that have huge investor backing. I think there’s finally coming a long overdue reckoning that nothing works well, unless unless the patients have have a good mental frame. And, and stop giving short shrift to that area. I think that’s that’s one of the huge new areas. That’s, that’s really taken off, as well as, as you pointed out telehealth. These these are these are areas that just have been given short shrift for a long time, and they’re cut and COVID has brought them into their own. And, and they’re and they’re gonna be they’re gonna be important, forever going forward.

Fred Goldstein 21:36

What’s your sense of this whole issue area of primary care sort of reference, you know, realignment? You know, is it going to be DPC? Is it on site clinics? Is it capitation? which parts of those do you think have the most benefit to help employers?

Brian Klepper 21:56

Well, you, you know that I was a, an owner in a in an on site clinic firm, for a number of years and, and what I learned was, was that primary care is the optimal place as the as the sort of gateway to the system to manage full continuum care and costs. And one of the things that I observed during that time was that most of the most of the clinic companies that I encountered, thought they were in the primary care business, when they were really in the full continuum risk management business. That, that, that that’s, that’s the future of primary care is is to be able to refer very carefully, identify, do early identification of problems, use evidence to, to, to attack the biggest kinds of problems in a population and manage them effectively to make sure that the right drugs get into the patient’s hands. Primary Care is going to become the specialty that manages overall complexity. And I think that the most forward thinking organizations in that space already do that. And, and, you know, here, we’re talking about organizations like, like Chen Med, like like Iora, like Vera Whole Health, like Care ATC. And I think that there are many old fashioned primary care groups in the wild, you know, accumulations of primary care doctors, who are rethinking how, you know, how they want to, to work and in the world, especially in an environment where they’ve been given the short end of the stick by the major health plans.

Fred Goldstein 23:50

And when you say full continuum, risk management, you’re, are you in essence talking about they are at risk for cost outside of the typical primary care practice?

Brian Klepper 24:03

Absolutely. Yeah. I think that I think that it is up to a primary care practice to demonstrate that, that when they get involved with a with a population, that total health care spend and an overall health, health care outcomes dramatically improve, you know, that they they are, they are truly the the quarterback, they’re not the gatekeeper. They’re the care. They’re there. They’re a patient advocate and guide, no matter where that patient is through throughout the system. And that, that that’s the that’s the fulfilling role of of primary care as it’s as it’s coming to be understood, I think,

Fred Goldstein 24:49

what are your thoughts regarding direct primary care DPC as as a front end vehicle for a health plan or benefits program? Is it We’re seeing a lot of people talk about it The future is Direct Primary Care. Do you see that much? Or? Or do you think that’ll work? Or what are your thoughts?

Brian Klepper 25:10

It’s probably a matter of semantics. But I don’t have I’m not a huge fan of Direct Primary Care, because because of a couple of things. One is, I don’t see Direct Primary Care organizations, investing in the kinds of management infrastructure that are necessary that are necessary to to identify and manage risk in various parts of the of the healthcare system. And I don’t see them offering up data that demonstrates that if you just use them and approach that everything gets better. So I think that there is a new kind of professional primary care organization that gets all that and it’s made the investments. And that’s really more of the future. I think that’s part of what we’re seeing with, with Walmart, Walmart wants to provide really good accessible primary care, that’s, that’s really cheap. But they haven’t really gotten their heads around to managing the risk that’s associated at the population level that primary care is capable of handling. And so there’s sort of, they haven’t really evolved with the new model yet. I think there are other organizations in retail that could jump into that breach organizations like, like Costco or Target, Kohl’s is interested in it, of course. And I think that those are very, that there’s potentially huge disruption within those or within those retail organizations and what they could mean for primary care.

Fred Goldstein 26:53

You know, we don’t have a lot of time here, Brian, and we’ll obviously have to get you back on again. But you’ve been at this for, I won’t, I won’t age you or anything, because I’m up there, too. But for quite a long time, and obviously pushing this issue consistently for years. Are we finally seeing the tipping point?

Brian Klepper 27:15

I think we are. I’m actually more encouraged than I’ve been at any time, in the last 25, 30 years, that things are possible that things can change. And for the better. Because I see, I see lots of employers, you know, taking steps to, to do things differently. And to say no, to the, to the conventional approaches. I don’t think that United has anything to worry about for me in the near future. But But I, I see way more innovation happening now than ever before, and a greater willingness by purchasers to be discerning and to be receptive to alternatives that have been proven to work in the marketplace.

Fred Goldstein 28:08

Well, that’s fantastic to hear, Brian. I know we’ve discussed this for many years, and worked together on and off over those years. It’s fantastic that you think that we might actually be seeing some of this change. And so thanks so much for joining us this week on PopHealth Week.

Brian Klepper 28:22

It’s been a pleasure. It’s a treat, as always, thanks so much, Fred.

Fred Goldstein 28:25

Thank you again. And back to you, Greg.

Gregg Masters 28:27

And that is the last word in today’s broadcast. I want to thank Brian Klepper, PhD, a healthcare analyst, commentator, entrepreneur and principal of Healthcare Performance Inc, and Worksite Health Advisors for his time and insights today. do follow Brian’s work on Twitter by @BKlepper the number one that’s B K L E P P E R the number one and Worksite Health advisors www.worksitehealthadvisors.com. And finally, if you’re enjoying our work here at PopHealth Week, as much as we are, please like the show and the podcast platform of your choice, and do consider subscribing to keep up with new episodes as they become available. For PopHealth Week, my colleague Fred Goldstein, and Health Innovation Media, this is Gregg Masters saying bye now.